The barangay however shall have the power to collect the said tax only if the barangay has levied the tax pursuant to an ordinance duly enacted by its Sanggunian. Only the legislature can impose taxes high prerogative of sovereignty 3.

Which Of The Following Has No Power Of Taxation Rpcpa A Provinces B Cities C Course Hero

Such taxes fees andcharges shall accrue exclusively to the local government units.

A barangay has the power of taxation. Basic Tax of P500 shall be collected up to February 28 2011 In case of delayed payment an interest of 2 per month shall be charged or P10. Nature of Power of Taxation 1 power is inherent in the state. Power to Generate and Apply Resources RA No.

- The Sangguniang Barangay the legislative body of the Barangay shall be composed of the Punong Barangay as presiding officer and the seven 7 regular Sangguniang Barangay members elected at large and Sangguniang Kabataan chairman as members. For the use of the barangay. So what exactly does a punong barangay do If the position is akin to that of a President Governor or mayor then a Punong barangay is a powerful position.

Powers Duties and Functions. To a for-profit government corporation. The power to impose a tax fee or charge or to generate revenue under this Code shall be exercised by the Sanggunian of the local government unit concerned through an appropriate ordinance.

Guillen is a mining operator. 1 On commercial breeding of fighting cocks cockfighting an cockpits. COMMUNITY RESIDENCE TAX.

Class A CTC usually refers to the Basic TaxUnemployed P500. The improvement of the barangay rests on the barangay officials. 7160 The Local Government Code of 1991 - Local government units shall have the power and authority to establish an organization that shall be responsible for the efficient and effective implementation of their development plans program objectives and priority.

Chapter Other Fees and Charges - The Barangay may levy reasonable fees and charges. What are the sources of income of a barangay from the exercise of its taxing powers. To raise revenues - answer.

Well you are right the position is powerful and has a lot of responsibilities. The scope of the power of taxation is unlimited. The following statement is incorrect except.

Only Congress can exercise the power of taxation b. To a school which is a stock corporation. The power of taxation is supreme plenary unlimited and comprehensive.

Barangays power and authority This is the Barangay Code of the Philippines. That he derives no benefit from the tax. It is clear that barangay may only impose levy assess and impose tax on stores or retailers with fixed business establishments with gross sales or receipts of the preceding calendar year ofP50 00000 or P30 00000 depending on whether the barangay is located in a city or in a municipality.

Each local government unit shall have the power to create its own sources of revenues and to levy taxes fees and charges subject to such guidelines and limitations as the Congress may provide consistent with the basic policy of local autonomy. The state can have the power of taxation even if the constitution does not expressly give it the power to tax. It may be exercises although not expressly granted by the constitution.

The tax Guillen has to pay based on the actual value of the gross output or mineral products extracted is a. 2 is essentially a legislative function. His mineral lands are not covered by any lease contract.

19 Series of 2014 imposing a P5000 tax on all the tourists. How are conflicts or tax issues resolved. Power to Create Sources of Revenue.

The barangay has power and authority over its domain. On the average there is a barangay for every 2500 Filipinos. Its share of the 20 allocation to the barangays of the internal revenue allotment ira of the.

The barangay chairman the barangay council and the local businessmen forge the prosperity of the barangay. - a The Sangguniang Barangay as the. Subject to inherent and constitutional limitation.

The Barangay System. And barangays shall not extend to the levy of income tax except when levied on banks and other financial institutions. I HAVE always thought that the barangay system if properly harnessed can provide great benefits to the country in molding the desired cultural and social character of the Filipino.

The barangay chairman the barangay council and the local businessmen forge the prosperity of the barangay. - Each local government unit shall exercise its power to create its own sources of revenue and to levy taxes fees and charges subject to the provisions herein consistent with the basic policy of local autonomy. The primary purpose of taxation is.

25 of the basic real estate tax collected in the barangay the share of a barangay in a city and in a metro manila political unit is computed a little differently. To protect local industries against unfair competition. To reduce social inequality.

Otherwise the tax shall be collectible by the municipality or city where the barangay is located subject to the same condition that either the municipality or city must have enacted the ordinance levying the tax on retailers. The municipal hall city hall the provincial capitol building and even the Malacañang Palace where the president resides is within a Barangay. The following are the constitutional limitations on the power of taxation except a.

BARANGAY ORDINANCE NO. That there is lack of territorial jurisdiction. It is being collected by the City Treasurer who can deputize the Barangay Treasurer for the collection.

Based ability to pay 4. Proceeds from the sale or lease of barangay property or from loans and grants secured by the barangay government 3. 16 RA 7160 Every local government unit shall exercise the powers expressly granted those necessarily implied therefrom as well as powers necessary appropriate or incidental for its efficient and effective governance and those which are essential to the promotion of the general welfare.

The barangay has power and authority over its domain. There are currently a little over 42000 barangays all over the country. That he has been deprived of the due process.

Gaviola WHEREAS Section 129 of the Local Government Code of 1991 RA. Barangays are authorized to generate income from taxes on stores or retailers with fixed business establishments and gross sales or receipts in the preceding year of P50000 or less in cities and P30000 or less in municipalities at the rate not exceeding one percent 1 on such. In consideration of marriage.

With regard to funding the finances of a barangay come mostly from three sources. Conflicts or tax issues that may arise between a barangay and its mother municipality or city from the exercise of its taxing power shall be resolved at the local level. Such taxes fees and charges shall accrue exclusively to the local governments.

Which of the following is not correct. The power of taxation is based on necessity because without money the state cannot survive. That the prescriptive period for the tax has elapsed.

For the exercise of the power of taxation the state can tax anything at. TAXING POWER OF LGUs Section 18. Taxation is penal in nature.

The improvement of the barangay rests on the barangay officials. In accordance with the Local Government Code LGC the Sangguniang Panglungsod SP of Baguio City enacted Tax Ordinance No. Hence it may be exercised by the state without any Constitutional provisions granting it.

Xxx local government units shall ensure and support among. To encourage the growth of local industries. 02 Series of 2008 AN ORDINANCE ENACTING THE REVISED BARANGAY OMNIBUS TAX CODE OF DEL MONTE ISLAND GARDEN CITY OF SAMAL DAVAO DEL NORTE Sponsored by.

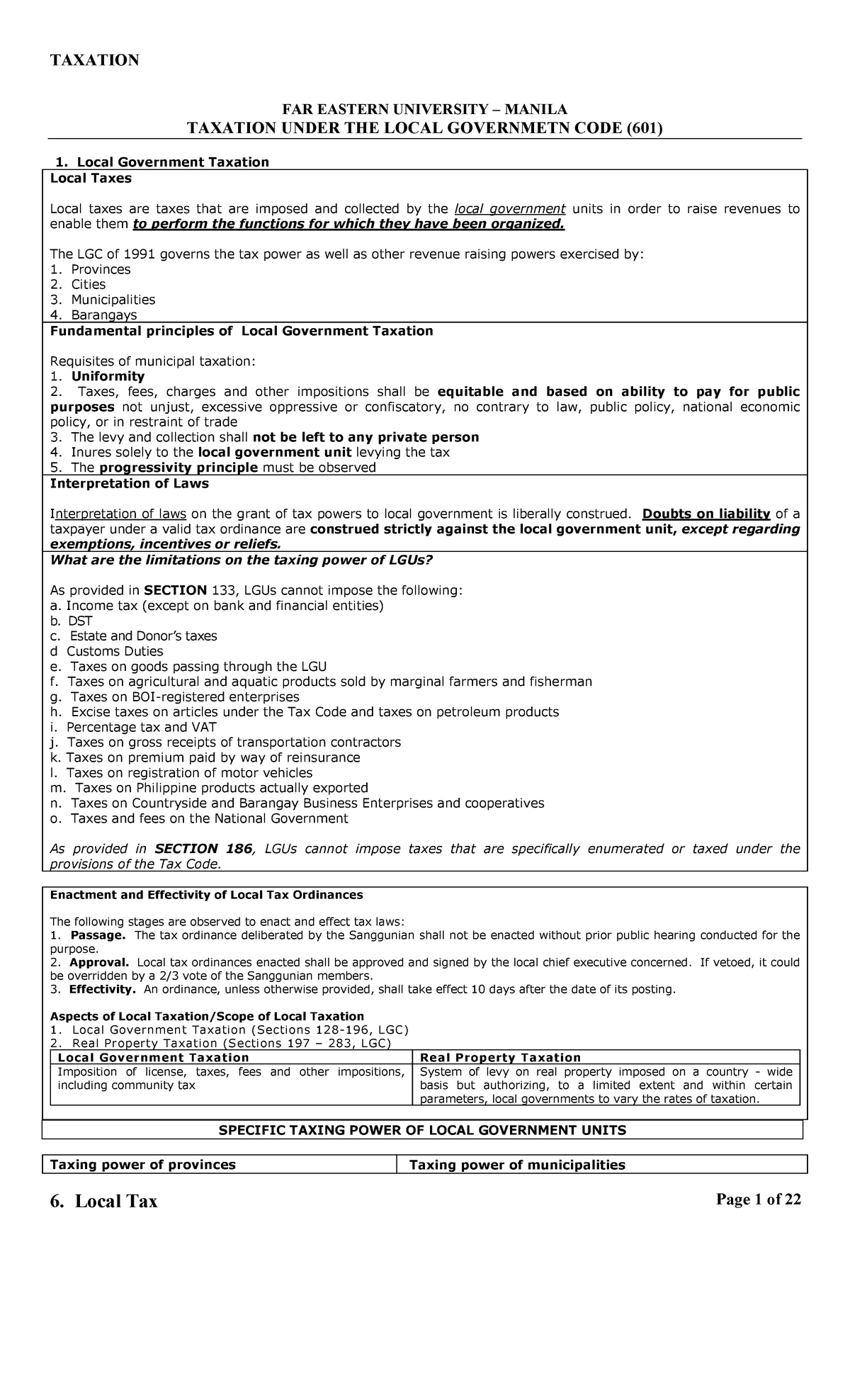

6 Taxation Under Local Government Accountancy Ac1218 Feu Studocu

Tidak ada komentar